Physical address

4 Merchant Place Corner Fredman Drive and Rivonia Road Sandton 2196

Postal address

PO Box 650149 Benmore 2010

Contact numbers

T: +27 11 282 1808 F: +27 11 282 8088

Use the app to manage your credit card anywhere, anytime, on the go, 24/7.

How to increase your credit card limit How to download your credit card statements How to temporarily block your credit card How to unblock your credit card How to transfer money from your cheque account to your credit card How to redeem vouchersStep 1: Login to the FNB Banking App

Step 2: Open the menu and select Accounts

Step 3: Select your Credit Card Account

Step 4: Select Increase Credit Limit

Step 5: Accept the upgrade requirements, update your annual income and select Continue

Step 6: Complete the Affordability Details and select Continue

Step 7: Review your credit limit increase and select Continue

Step 8: Carefully read through your Credit Offer and select Confirm to finish

Step 1: Login to the FNB Banking App

Step 2: Open the menu and select Accounts

Step 3: Select your Credit Card Account

Step 4: Select Statement History

Step 5: Enter your email address and choose which statement to download

Step 6: Select Confirm to accept your selection

Step 7: Select Finish to complete your request

Step 1: Login to the FNB Banking App

Step 2: Open the menu and select Accounts

Step 3: Select your Credit Card Account

Step 4: Select Cards and then the card you wish to temporarily block

Step 5: Select Temporarily Block My Card to complete your request

Step 6: Select Confirm and then Finish to complete your request

Step 1: Login to the FNB Banking App

Step 2: Open the menu and select Accounts

Step 3: Select your Credit Card Account

Step 4: Select Cards and then the card you wish to unblock

Step 5: Select Unblock My Card

Step 6: Select Confirm and then Finish to complete your request

Step 1: Login to the FNB Banking App

Step 2: Open the menu and select Transfers

Step 3: Choose the From and To accounts as well as the amount you wish to transfer , and then select Transfer

Step 4: Review your transfer details and select Confirm to continue

Step 5: Select Finish to complete the transfer

Step 1: Login to the FNB Banking App

Step 2: Select My Vouchers

Step 3: From the list of available vouchers, choose the voucher you want to redeem by selecting Redeem

Step 4: Enter your FNB Online Banking Password to login and view the voucher code

Step 5: Use the on-screen voucher code at the cashier till or at the online check-out select Finish when done

A credit score is a number that reflects the likelihood of you paying credit back. Lenders like banks and financial service providers look at your credit history when they calculate your credit score, which will in turn show them the level of risk involved in lending money to you. This also plays a part in determining how much money you can borrow from a bank, lender or credit provider.

How are credit scores calculated?

Financial service providers look at two main things when calculating a credit score:

1. Affordability, i.e. your ability to repay the debt.

2. Credit worthiness, i.e. your willingness to repay the debt. There are several things you can do to improve this:

Want to know what your own credit score is? As a South African citizen you get

one free credit report per year.

To get your free report, visit the TransUnion website or mycreditstatus.co.za.

Many people are scared of the concept of credit, as it involves owing money to a bank or credit provider. But the truth is that there are both good and bad forms of credit. Here's the difference between the two:

Good credit:

This is when you borrow money for a good reason, such as to buy a house or to finance a car. It also includes getting a personal or business loan for a specific purpose - such as paying for renovations or buying stock for your business. In these cases if you can afford the repayments and the debt will only be for a certain amount of time, these kinds of loans can improve your credit score.

Bad credit:

This is money that you borrow for no compelling or specific reason, such as a payday loan to simply help you get through the month. These kinds of loans often come with high interest rates, which can make them very difficult to pay back. These loans are considered to be bad forms of credit, as they can lower your credit score.

Is a credit card considered "good" credit?

When it's used responsibly, a credit card can help you build a good credit history. Unfortunately, you need to have a credit rating first in order to get a credit card, which may be tricky if you've never applied for credit before. If it's your first time applying for credit, ask for a lower limit or prefund your credit card so you can get used to managing your account.

A credit card can also be an excellent way of consolidating your debt. Instead of having multiple store accounts, you can pay off all your accounts using your credit card, which means you consolidate your debt onto one card and in one account - with one monthly statement and one interest rate.

When you buy something with your credit card, you can choose to buy it using a "straight" or "budget" option:

Budget:

This is when the full amount is placed over a period of months at a fixed instalment rate on a reducing balance. You can place any purchase larger than R200 on budget and choose a repayment period of 6 to 60 months.

Straight:

When you use this facility, you can pay the outstanding balance on a monthly basis, or on a revolving basis. Making purchases on your straight facility can be beneficial as you don't have to pay any interest if you repay the whole amount within 55 days.

Credit Card Limit Shift:

Credit limit shift gives you the ability to split and move you total available credit limit between your straight and budget facility on a specific credit card. This does not increase or decrease your current credit limit but allocates your total available limit between the two facilities.

1. Log onto the FNB / RMBPB App

2. Click on the Account icon.

3. Click on Credit Card Account

4. Click on Accounts Options

5. Click on Credit Limit Shift icon.

Set your limits by either typing the amount in the field or moving the scroller to the desired amount. Budget facility cannot exceed 80% of your total credit limit.

What it is

An interest free period on a credit card is the period in which you can purchase using your credit card without having to pay interest on those purchases.

To avoid paying any interest on purchases made with your credit card you must pay your full closing balance by the payment due date every month, failure to clear the full balance on your credit card will mean you will lose the 55 interest free period for your next and current statement period.

What you get

Enjoy up to 55 days interest free on purchases made on your straight FNB Credit Card facility. Purchases do not include cash transactions, traveller's cheque purchases and certain forex transactions. For a detailed list of exclusions please see the Terms and Conditions. For any card enquiries call us on 087 575 1111, email us at fnbcard@fnb.co.za or visit your nearest FNB branch

For fast applications call 0860 FASTAP (327827).

Terms and conditions apply

Doing your banking using the FNB Banking App gives you full control of your credit card 24/7, no matter where you are. Using the app means you can:

Sometimes life takes an unexpected turn and you may find yourself in a difficult situation and unable to make payments on your credit card.

What do you do if you were to be faced with this unfortunate situation?

Keep the Collections team informed of your financial difficulty

Repayment methods

Impact of an account being in arrears

To make life a little easier, we have different credit card repayment methods available namely:

Have a conservative credit card limit.

Make sure your credit card limit is an amount you're comfortable with, one you know you'll be able to afford to pay back monthly. Having a very high credit limit can be tempting, without considering the repayments that will be required afterwards.

Remember: the more you spend, the more you'll have to repay, as the minimum 5% monthly repayment amount is calculated on the full outstanding balance plus any budget instalments.

Tip: You can easily increase your credit card limit via the FNB Banking App when you need a higher limit.

Don't change your spending behaviour.

Having available credit doesn't mean you must use all of it.

Take advantage of the 55 days interest free period by paying the account balance reflected on your statement in full to avoid incurring interest. Note: fuel transactions and cash withdrawals will incur interest immediately.

Paying the full outstanding amount of the credit card purchase to avoid incurring interest.

Use your free budget facility.

If you're making large purchases of R200 and up, our FREE budget facility is ideal for making larger purchases that you can then pay off over a period of 6 to 60 months.

View your credit card statements each month.

This will help you keep track of your spending habits and raise any disputes straight away. Knowing what you spend every month on different items will help you to spend more responsibly.

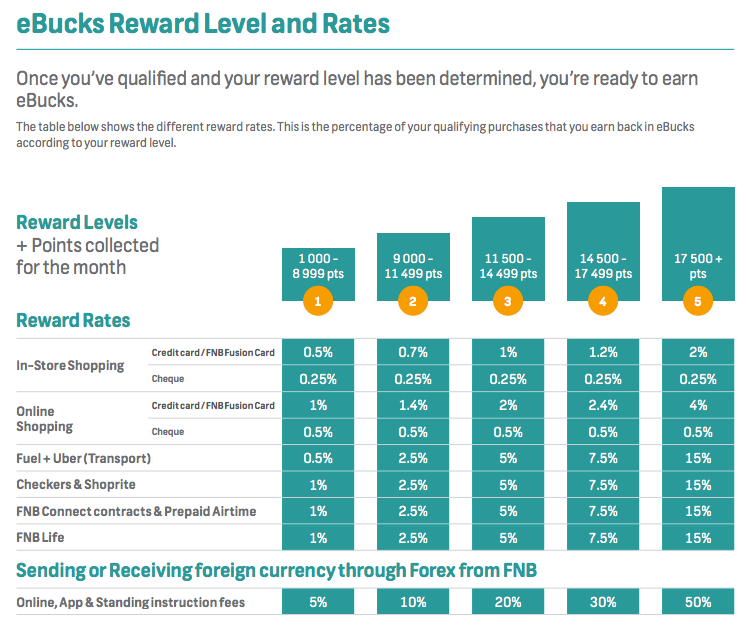

How to move up a Reward Level

After you've qualified, the second step is to move up a reward level. Your reward level is determined by how many points you've collected in a calendar month. You collect points based on how you bank. The more points you collect, the higher your reward level.

Your reward level is reviewed monthly, which means that you may be on a different reward level every month. Visit the eBucks website to try our handy eBucks Rewards Calculator for tips on how to move up a reward level.

Bank cards offer a lot of benefits, and far outweigh the risk and expenses associated with handling cash. Despite this, there are still security risks with using your card - which is why it comes with several security features designed to minimise fraud, while improving convenience for you. Remember that card safety is a two-way street between you and your bank, so in addition to your bank's protection measures, you should always exercise caution so you don't fall victim to fraudulent activities.

Follow these tips to avoid card fraud;

Staying safe at an ATM:

When considering shopping online, make sure you're dealing with a reputable retailer before sharing any personal information or your card details.

Follow these tips to avoid fraud when shopping online:

1. Activate any additional security features

As soon as you receive your credit card activate Online Secure. Online Secure is an additional security layer provided by FNB and Visa that requires an OTP (One Time PIN) to be entered before the online payment can be completed.

2. Don't use public Wifi hotspots to shop online

Every time you enter your personal information using a public network, you're exposing your details to potential hackers. Public Wifi hotspots don't encrypt your data. If you're planning on entering sensitive credit card details, rather use your secure WiFi connection at home or office.

3. Frequently check your credit card statements

We can't always catch fraudulent transactions and we rely on you to always keep an eye on your credit card statement to spot purchases you didn't make or receive. If you notice or suspect a fraudulent transaction, immediately dispute the transaction and block or cancel your card to avoid further fraudulent activity.

4. Look for HTTPS in the URL and the lock icon

The most important thing to look out for when your shopping online is the additional 'S' in the URL. The 'S' means the website is secure and that your information is sent through a secure portal. Another obvious sign that you're on a secure website is the lock icon in the URL bar. Be careful with the information you share on HTTP sites and if a broken lock icon is displayed.

5. Never click on links in emails

Rather type out the full website address in your browser. Most phishing scams duplicate legitimate sites you would normally trust, like bank sites and online retailer sites. Once you enter your personal information on the fake site your information is stolen. Real sites, especially banks will never ask for your personal information over an email. If you have any doubts, contact the bank or retailer immediately.

6. Change your online account passwords frequently

To stay safe when shopping online it's crucial to update your online account passwords every three to six months and never use the same password for all your accounts.

Call us

If your card is lost, stolen or has been used fraudulently, contact us on the following numbers:

Alternatively, you can phone the number on the back of your card with any queries you may have.

Report fraud via the app

Instead of receiving your OTP via SMS, Smart inContact uses interactive messaging via the app, so that you can approve these transactions securely. Smart inContact provides you with the means to easily and quickly report fraud via the app for any suspicious swipes, withdrawals, debit orders, payments, transfers and more.

Tap your contactless card. It's that simple.

Contactlesss technology allows you to make fast and secure payments for low value purchases by simply tapping your card on a contactless enabled point-of-sale device.

For larger purchases you will be required to insert your PIN as usual.

Contact the Global Travel Insurance Help Desk on 0861 490 100 to activate the benefit.

If you're planning on travelling locally or abroad, be sure to let us know of your plans by phoning the number on the back of your card, so that we can monitor your transactions and check for any suspicious transactions.

In the event that your card gets lost or stolen, you have the following three options

1. Phone the FNB Credit Card or Fraud Division on 087 575 9444 or +27 11 352 5910.

2. Cancel or block your card instantly on the FNB Banking App, you can also order a new card.

3. Contact Visa Global Customer Assistance Service (GCAS) on 0800 990 47 for an emergency cash payout or medical assistance.

Use your FNB Credit Card Budget Facility for any purchase from 1 November 2024 through 31 January 2025 and pay Prime +2% for the first 6 Months. T's&C's apply.

A credit card's interest rate is the price you pay for borrowing money. With credit cards, the interest rates are typically stated as a yearly rate, which is called the annual percentage rate (APR).

Using a credit card is one of the smartest and most convenient ways to book your return travel tickets and accommodation online.

Choose a credit solution that suits your lifestyle

Annual income

R60 000 - R450 000

Annual income

R300 000 - R749 999

Annual income

R750 000 - R1 799 999

Annual income

R1 800 000 or more

Physical address

4 Merchant Place Corner Fredman Drive and Rivonia Road Sandton 2196

Postal address

PO Box 650149 Benmore 2010

Contact numbers

T: +27 11 282 1808 F: +27 11 282 8088