FNB Life Insurance

Does your bank help you with life insurance?

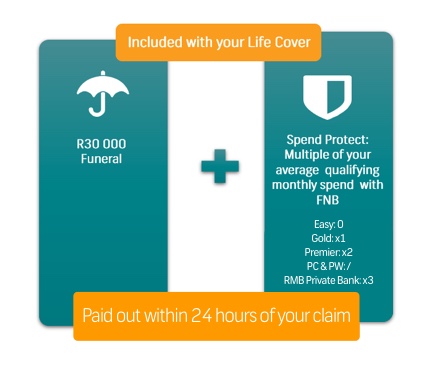

Life Insurance shouldn't be a one-size-fits-all. This is why we offer a product range which can be personalised to meet your unique needs and profile.

Our goal is to create life insurance products with you, our customer at the centre - in death, disability, critical illness or retrenchment

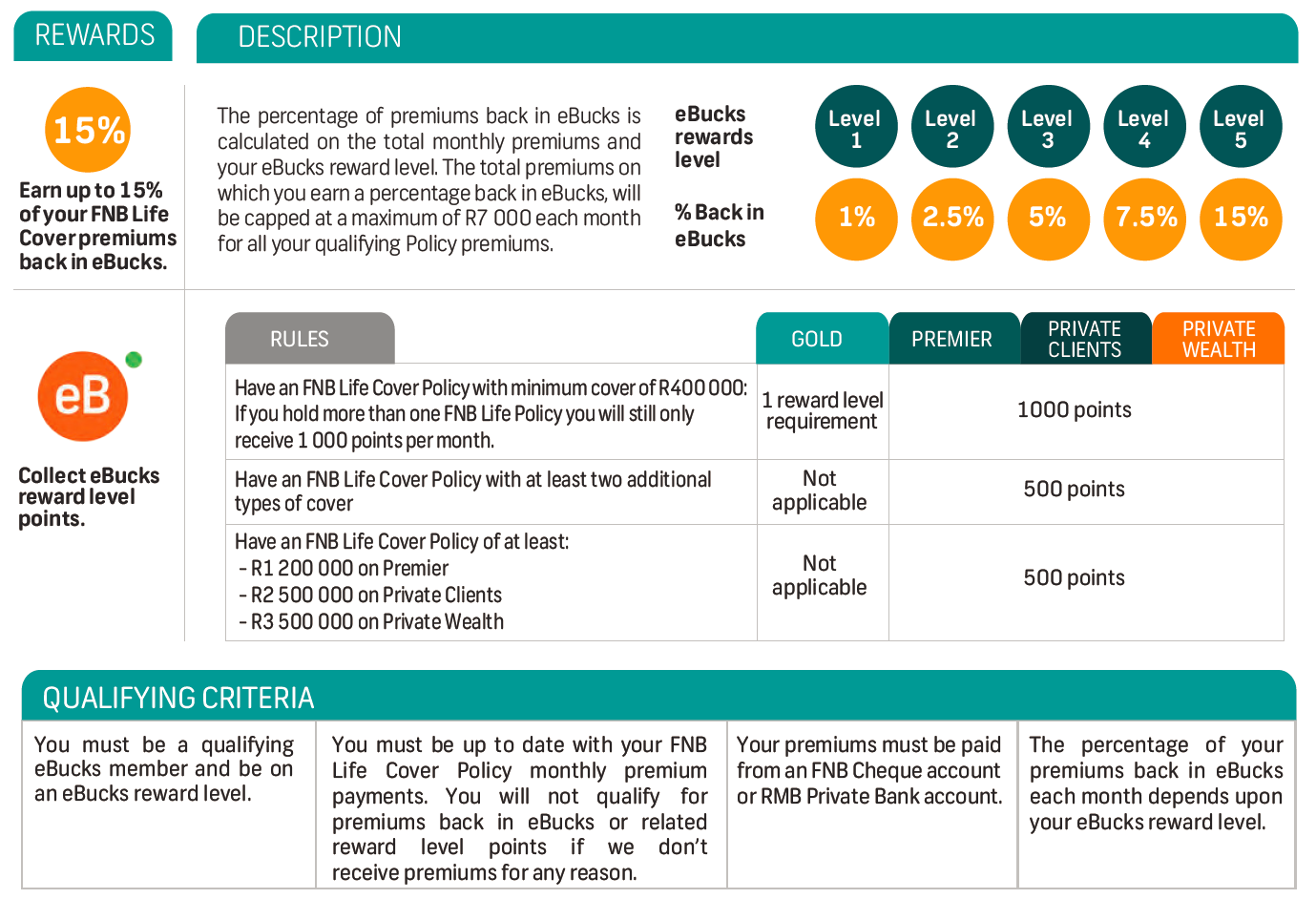

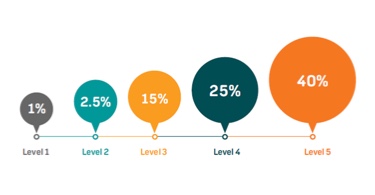

Earn eBucks for choosing

Earn up to 40% of your premium back in eBucks

Earn up to 40% back in eBucks on your FNB Life Customised or Dynamic Life monthly premiums.

Earn up to 25% back in eBucks on your FNB Life Simplified monthly premiums.

As an FNB Fusion or Cheque account holder, you could collect up to 2500 points towards your eBucks reward level each month.

To find out how to collect points and earn eBucks from your Life Cover, or for more details on the eBucks Rewards programme, please visit www.eBucks.com.

eBucks is embedded in the insurance product and earn depends on meeting and maintaining qualifying criteria.

Looking after your loved ones

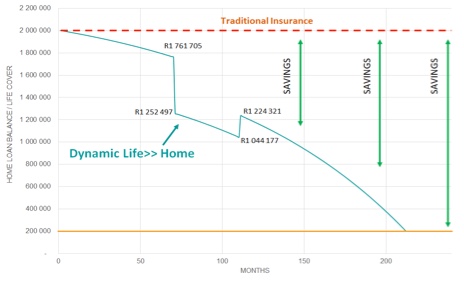

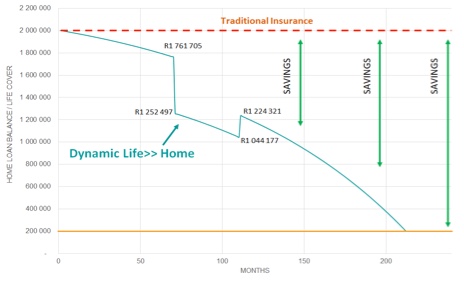

Dynamic Life» Home

Whatever happens, ensure you have a

roof over yours and your loved ones'

heads.

Life insurance online

How to get Life Insurance online